Introduction: 8 Compelling Reasons for Consumers and Merchants

In a world where digital wallets are becoming the norm, Apple Pay stands out as a popular choice for contactless payments. However, before fully embracing this technology, both consumers and merchants should weigh the pros and cons. In this article, we’ll delve into 8 compelling reasons why you might want to think twice before using Apple Pay for your transactions. Join us as we navigate the intricacies of this digital payment system and explore its potential drawbacks.

1. Vulnerability to Cyberattacks:

Apple Pay boasts impressive security measures, but a jailbroken iPhone could compromise the system. Learn why it’s crucial to maintain the integrity of your device’s software to ensure a safe payment experience.

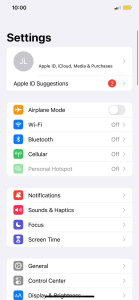

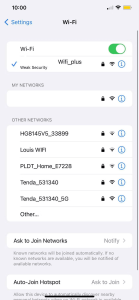

2. Public Wi-Fi Connections Compromise Security:

While Apple Pay doesn’t require internet connectivity, your iPhone’s automatic search for public Wi-Fi networks poses a threat. Understand the risks of unauthorized contactless payments on public networks and discover how to safeguard your transactions.

3. Potential to Bypass Contactless Limits Without Authorization:

Dig into research exposing Apple Pay’s susceptibility to payment fraud. Find out how hackers could exploit Express Transit mode and learn how to protect yourself from potential fraudulent transactions.

4. Apple Collects Significant Personal Data:

Privacy concerns take center stage as we explore the personal information Apple Pay requires. Delve into the implications of sharing your transaction history and consider whether the convenience of Apple Pay outweighs the privacy trade-off.

5. Apple Pay Only Works on Apple Devices:

Discover a limitation of Apple Pay: it’s exclusive to Apple devices. Explore how this restriction might affect your payment choices and whether you’re prepared to commit to Apple’s ecosystem.

6. Confusion and Irritability Among New Users:

For merchants, catering to diverse payment preferences is essential. Learn about the challenges of customers using Apple Pay for the first time and find out how offering alternative payment methods can enhance the shopping experience.

7. Failed Transactions Due to Card Clash:

Uncover the issue of “card clashes” that can disrupt contactless transactions. Explore why this problem might arise and discover the potential complications it could bring to your business.

8. Implementation Cost:

While Apple Pay doesn’t charge merchants fees, there are still costs associated with implementation. Dive into the expenses of getting NFC payment terminals and training staff, and determine whether the benefits outweigh the financial investment.

Is Apple Pay Worth It?

After exploring these 8 reasons, it’s time to weigh the pros and cons. While Apple Pay offers convenience, faster checkouts, and security, its disadvantages can’t be ignored. As technology evolves, Apple is likely to address these concerns, making Apple Pay more robust and secure. Ultimately, the decision rests on your individual needs and preferences. Are the advantages of Apple Pay compelling enough to outweigh its drawbacks? The choice is yours.

About the Author:

Meet Aria Tricia, a tech enthusiast and finance expert. With years of experience in both the tech and financial sectors, Aria has gained valuable insights into the intersection of digital payment systems and consumer needs. Her passion for simplifying complex financial concepts for everyday readers makes her a reliable guide through the intricacies of modern payment solutions.

Conclusion:

As digital payment methods continue to shape the way we handle transactions, it’s essential to consider the potential drawbacks alongside the benefits. Apple Pay, though convenient, comes with its fair share of concerns. From security vulnerabilities to implementation costs, consumers and merchants must make informed decisions. By delving into these 8 reasons, you’re equipped to navigate the world of digital wallets with a clear understanding of whether Apple Pay is the right choice for you.