Introduction

In today’s Higher Education Trends rapidly evolving world, higher education is experiencing profound shifts. “Higher Education Trends: Adapting to Change” encompasses various changes in educational delivery, student expectations, and institutional strategies. Let’s delve into these trends and explore how institutions are adapting to ensure quality education in a dynamic environment.

Embracing Technological Advancements

Institutions are integrating technology into educational practices to enhance learning experiences. Embracing online platforms, interactive tools, and virtual classrooms facilitates remote learning and accommodates diverse student needs. The incorporation of artificial intelligence and virtual reality revolutionizes teaching methodologies, fostering engagement and personalized learning experiences.

Diversity and Inclusion Initiatives

Higher Education Trends Promoting diversity and inclusion is paramount in modern higher education. Institutions are implementing proactive measures to foster inclusive environments, celebrate diversity, and address systemic inequalities. Initiatives such as multicultural programming, sensitivity training, and inclusive curriculum development empower students from all backgrounds to thrive academically and socially.

Addressing Student Mental Health

Higher Education Trends Recognizing the importance of student well-being, universities are prioritizing mental health initiatives. Counseling services, peer support groups, and wellness programs are integral components of campus life, providing students with essential resources and support networks. By nurturing holistic wellness, institutions cultivate resilient and thriving student communities.

Flexible Learning Modalities

The demand for flexible learning modalities is reshaping higher education. Blended learning approaches, including hybrid courses and flipped classrooms, cater to diverse learning preferences and schedules. Adaptive learning technologies personalize educational experiences, allowing students to progress at their own pace while accommodating individual learning styles.

Globalization of Education

Higher Education Trends The globalization of education transcends geographical boundaries, offering students opportunities for international collaboration and cultural exchange. Study abroad programs, international partnerships, and cross-cultural initiatives enrich academic experiences and cultivate global perspectives. By embracing diversity and interconnectedness, institutions prepare students to navigate a globally interconnected society.

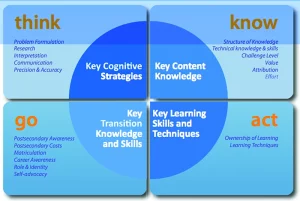

Rise of Competency-Based Education

Competency-based education prioritizes mastery of skills and knowledge over traditional time-based metrics. By focusing on measurable learning outcomes, competency-based programs empower students to progress based on demonstrated proficiency. This learner-centric approach fosters self-directed learning and promotes mastery of essential competencies relevant to future careers.

Enhancing Career Readiness

In response to evolving workforce demands, Higher Education Trends are enhancing career readiness initiatives. Internship programs, experiential learning opportunities, and industry partnerships bridge the gap between academia and the workforce. By equipping students with practical skills, critical thinking abilities, and professional experiences, institutions prepare graduates for successful careers in a competitive job market.

Sustainability and Environmental Awareness

Higher Education Trends Promoting sustainability and environmental awareness is integral to higher education’s societal role. Institutions are implementing eco-friendly practices, incorporating sustainability into curricula, and fostering environmental stewardship among students. By instilling a sense of responsibility for environmental conservation, universities prepare future leaders to address pressing global challenges.

Adapting Curriculum to Industry Trends

To remain relevant in a rapidly evolving job market, universities are adapting curricula to reflect industry trends. Integrating emerging technologies, interdisciplinary studies, and real-world applications enhances the practical relevance of educational programs. By aligning curriculum with industry demands, institutions empower graduates with the skills and knowledge necessary for professional success.

Data-Driven Decision Making

Data-driven decision making is becoming increasingly prevalent in higher education administration. Utilizing analytics and predictive modeling, institutions gain insights into student performance, enrollment trends, and resource allocation. By leveraging data-driven strategies, universities optimize operations, enhance student outcomes, and drive institutional effectiveness.

Promoting Lifelong Learning

In the era of continuous technological advancement, promoting lifelong learning is essential. Universities are expanding access to continuing education programs, professional development courses, and lifelong learning initiatives. By fostering a culture of lifelong learning, institutions empower individuals to adapt to change, pursue personal growth, and remain competitive in a dynamic job market.

Community Engagement and Social Impact

Engaging with local communities and addressing societal challenges is integral to Higher Education Trends mission. Service-learning projects, community partnerships, and civic engagement initiatives enable students to apply classroom knowledge to real-world issues. By fostering social responsibility and civic engagement, institutions cultivate socially conscious leaders committed to positive change.

Conclusion

In the ever-evolving landscape of Higher Education Trends, institutions must adapt to emerging trends to provide quality education and support student success. By embracing technological advancements, fostering diversity and inclusion, and prioritizing student well-being, universities can navigate change effectively. As the educational landscape continues to evolve, institutions play a vital role in shaping the future of learning and preparing students for success in a dynamic world.

FAQs (Frequently Asked Questions)

How are universities adapting to online learning trends?

Universities are investing in robust online platforms, virtual classrooms, and interactive tools to facilitate remote learning experiences. Additionally, institutions are enhancing technical support services and providing professional development opportunities for faculty to adapt to online teaching methodologies.

What measures are universities implementing to support student mental health?

Universities are expanding mental health services, offering counseling, therapy, and wellness programs to support student well-being. Peer support groups, mindfulness workshops, and mental health awareness campaigns promote holistic wellness and resilience among students.

How do competency-based education programs differ from traditional academic models?

Competency-based education focuses on mastery of specific skills and knowledge, allowing students to progress at their own pace. Unlike traditional models based on seat time, competency-based programs emphasize learning outcomes and individualized learning pathways tailored to student needs.

What role does sustainability play in higher education curriculum?

Sustainability is integrated into higher education curricula through interdisciplinary courses, research projects, and sustainability-focused initiatives. By exploring environmental issues, sustainable practices, and social responsibility, students develop a holistic understanding of global challenges and solutions.

How do universities collaborate with industries to enhance career readiness?

Universities collaborate with industries through internship programs, experiential learning opportunities, and advisory boards to align educational offerings with industry needs. By fostering partnerships, universities provide students with hands-on experiences, mentorship, and networking opportunities to enhance their career readiness.