Introduction:

In the tumultuous world of finance, the silence of bond vigilantes in the Treasury market is deafening. Despite borrowing challenges, they remain remarkably quiet. Join us as we unravel the mysteries behind their dormancy and its impact on investors navigating this critical financial landscape.

1. Bond Vigilantes Unveiled:

Bond vigilantes, once powerful market actors, have historically influenced government borrowing costs by selling bonds. Understand their historical significance and their role as guardians of fiscal responsibility.

2. The Quietude of the Treasury Market:

Despite economic headwinds and borrowing challenges, the Treasury market remains surprisingly tranquil. Explore the factors contributing to this calmness, including central bank interventions, investor sentiment, and market dynamics.

3. Dormant Vigilantes:

In a departure from historical norms, bond vigilantes seem to have taken a backseat, showing little reaction to borrowing boundaries. Uncover the reasons behind their dormancy, such as central bank actions, subdued inflation, and global economic conditions.

4. Impact of Central Bank Interventions:

Central banks’ unprecedented interventions, such as quantitative easing and asset purchases, have reshaped bond market dynamics. Examine how these interventions have influenced bond yields and potentially muted the response of bond vigilantes.

5. Global Economic Dynamics:

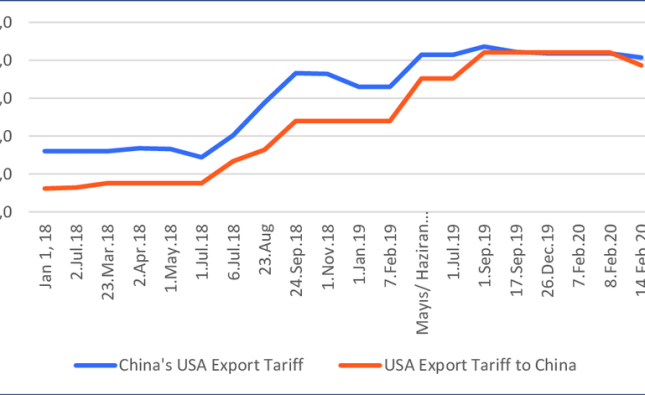

In an interconnected world, global economic factors play a pivotal role in shaping bond market dynamics. Analyze how geopolitical tensions, trade policies, and economic conditions abroad influence the behavior of bond vigilantes.

6. Investor Sentiment and Behavior:

Investor sentiment and behavior are key drivers of market dynamics. Explore how risk appetite, market sentiment, and economic outlook impact investor decisions and bond market reactions amidst the silence of bond vigilantes.

7. Implications for Investors:

The dormancy of bond vigilantes has profound implications for investors navigating the Treasury market. Assess the risks and opportunities in this quiet yet critical landscape, considering portfolio strategies and risk management approaches.

8. Future Outlook and Considerations:

As bond vigilantes stay silent and the Treasury market remains calm, investors contemplate the future trajectory of bond yields and market dynamics. Consider potential catalysts for the reactivation of bond vigilantes and their impact on future market conditions.

Visual Table: Key Points Overview

| Key Point | Description |

|---|---|

| Bond Vigilantes Unveiled | Understand the historical significance of bond vigilantes and their role in influencing government borrowing costs. |

| The Quietude of the Treasury Market | Explore the factors contributing to the calmness of the Treasury market amidst borrowing challenges. |

| Dormant Vigilantes | Uncover the reasons behind the dormancy of bond vigilantes and their muted response to borrowing boundaries. |

| Impact of Central Bank Interventions | Examine how central bank actions have reshaped bond market dynamics and potentially muted the response of vigilantes. |

| Global Economic Dynamics | Analyze how global economic factors influence bond market dynamics and the behavior of bond vigilantes. |

| Investor Sentiment and Behavior | Explore the impact of investor sentiment and behavior on bond market reactions amidst the silence of vigilantes. |

| Implications for Investors | Assess the risks and opportunities for investors navigating the Treasury market in the absence of bond vigilantes. |

| Future Outlook and Considerations | Consider potential catalysts for the reactivation of bond vigilantes and their impact on future market conditions. |

Comparative Table: Bond Market Conditions

| Indicator | Current Conditions | Implications | Future Outlook |

|---|---|---|---|

| Bond Yields | Stable | Reduced volatility for investors | Potential for uncertainty |

| Bond Vigilante Activity | Dormant | Limited pressure on government borrowing | Uncertainty prevails |

| Central Bank Interventions | High | Suppresses bond yields and market volatility | Continuation likely |

| Global Economic Factors | Mixed | Modest growth and subdued inflation | Impact on market sentiment |

| Investor Sentiment | Cautious | Market participants await further developments | Influence on market direction |

Through this exploration, we aim to shed light on the unusual silence of bond vigilantes in the Treasury market and its broader implications for investors navigating this quiet yet critical financial landscape.