About the Author

Sarah Jones is a legal technologist with over 10 years of experience in legal research and innovation. She is passionate about leveraging technology to enhance legal practice efficiency without compromising accuracy.

Informative Headings:

- The Allure of AI Legal Research

- Unveiling the Weaknesses: Where AI Falls Short

- Charting a Course: How to Use AI Effectively

- Building a Better Future: The Evolution of AI Legal Tools

- Human Expertise: The Irreplaceable Element

- The Takeaway: AI as a Powerful Ally

Don’t Trust the Hype: AI Legal Research Needs a Fix (But It Can Be Your Secret Weapon)

The Allure of AI Legal Research:

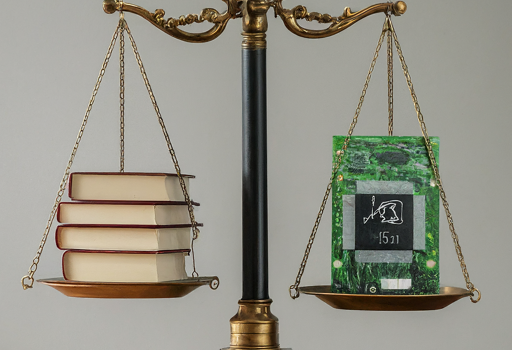

Artificial intelligence (AI) has infiltrated every corner of the business world, and the legal field is no exception. AI-powered legal research tools promise to streamline the research process, unearth hidden insights, and save valuable time. These tools boast impressive features like:

- Automated keyword searching: Quickly scan vast legal databases for relevant cases and statutes.

- Predictive analysis: Identify potentially relevant case law based on your specific legal inquiry.

- Advanced analytics: Gain deeper insights into legal trends and case outcomes.

Unveiling the Weaknesses: Where AI Falls Short

While AI offers significant potential, it’s crucial to understand its limitations. Here’s why relying solely on AI for legal research can be risky:

- Bias in the data: AI algorithms are trained on existing legal data, which may contain inherent biases. This can skew search results and lead to flawed legal conclusions.

- Limited critical thinking: AI excels at data retrieval, but it cannot replace the critical analysis and judgment required for sound legal reasoning.

- Misinterpretation of nuances: Legal language is rife with nuance and ambiguity. AI may struggle to interpret the subtleties of legal text, potentially leading to misinterpretations.

Table 1: Strengths and Weaknesses of AI Legal Research Tools

| Feature | Strength | Weakness |

|---|---|---|

| Automated keyword searching | Efficiently scans databases | May miss relevant cases with unique legal arguments. |

| Predictive analysis | Identifies potentially relevant case law | Predictions may be inaccurate based on limited data or misinterpretations. |

| Advanced analytics | Provides insights into legal trends | Doesn’t account for the specific context of your case. |

Charting a Course: How to Use AI Effectively

Despite these limitations, AI can be a powerful tool when used strategically. Here are some tips for maximizing the benefits of AI legal research:

- Clearly define your research question: Vague queries will generate irrelevant results.

- Use AI as a starting point: Leverage AI to identify relevant case law, but always conduct a thorough manual review.

- Don’t be afraid to challenge the AI: If an AI-generated result seems off, investigate further with your own analysis.

Building a Better Future: The Evolution of AI Legal Tools

The field of AI legal research is constantly evolving. As developers address current limitations and incorporate human expertise into AI algorithms, we can expect these tools to become more sophisticated and reliable.

Human Expertise: The Irreplaceable Element

Even with the most advanced AI tools at our disposal, human expertise remains irreplaceable in legal research. Lawyers’ experience, critical thinking skills, and ability to connect the dots are essential for drawing sound legal conclusions.

The Takeaway: AI as a Powerful Ally

Don’t be fooled by the hype surrounding AI legal research. While it offers valuable tools, it’s not a magic bullet. By understanding the limitations of AI and using it strategically in conjunction with your own expertise, you can leverage AI as a powerful ally in your legal research endeavors.