PayPal Alternatives for Friends and Family Payments

In a world where digital payments have become the norm, finding the right platform to send money to friends and family can make a world of difference. While PayPal is a widely-used option, it’s not the only one available. In this article, we’ll explore some fantastic alternatives to PayPal that make sending money to your loved ones quick and hassle-free.

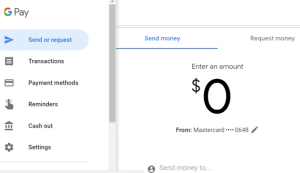

1. Google Pay

Google Pay, formerly known as Android Pay and Google Wallet, is Google’s mobile payment processing option. This platform has evolved over time to become an all-in-one mobile payment system. It’s not just about tapping and paying; it’s also an excellent choice for peer-to-peer (P2P) payments.

Advantages of Google Pay:

- Accepts payments from anyone with an email address or phone number, whether they use Google Pay or not.

- Instant cash-out to a bank account or debit card for recipients.

- Available to Gmail users, making transactions even more convenient.

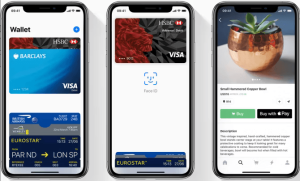

2. Apple Pay

Apple Pay, available on iPhones, iPads, and Apple Watches, offers a seamless payment experience. You can upload credit, debit, and loyalty cards for easy use with NFC payment terminals. While it’s a great choice, note that the recipient must also use Apple Pay to access funds sent to them.

Advantages of Apple Pay:

- Convenient payment of bills or sending money to family and friends.

- Compatible with a wide range of Apple devices.

Note: Recipients can receive money without Apple Pay, but the app is required to access and cash out the funds.

3. WeChat Pay

WeChat Pay, part of the WeChat messaging app, is a digital wallet and payment service. With over 1.1 billion users globally, it’s a prevalent choice. Even though it’s particularly popular in China, its growth worldwide is undeniable.

Advantages of WeChat Pay:

- Massive user base for easy transactions.

- Integrations with various Tencent services, expanding its utility.

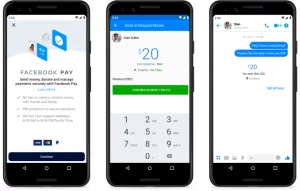

4. Facebook Messenger Payments

Despite privacy concerns, Facebook Messenger Payments are incredibly convenient. You can send and receive money from friends and family without incurring fees. Most importantly, it’s likely your friends already have Facebook accounts, simplifying the payment process.

Advantages of Facebook Messenger Payments:

- Seamless integration within Messenger for easy transactions.

- No fees for sending money to friends and family.

| PayPal Alternative | Availability | Key Features | Integration with Other Services | Fees for Sending Money |

|---|---|---|---|---|

| Google Pay | Android & iOS | Send money to anyone with an email or phone number | Integrates with Gmail | Free |

| Apple Pay | iOS & iPadOS | Easily send money to friends and family | Seamless integration with Apple devices | Free |

| WeChat Pay | Android & iOS | Huge user base globally | Integrations with Tencent services | May vary by region |

| Facebook Messenger Payments | Android & iOS | Send and receive money within Messenger | Integration within Messenger | Free |

This table provides a quick overview of these PayPal alternatives, helping you choose the one that best suits your needs for sending money to friends and family.

What Is the Best PayPal Alternative for Online Payments?

When it comes to sending money to friends and family, these PayPal alternatives offer diverse options to suit your needs. Apple users may prefer the integration of Apple Pay, while Android users can enjoy the convenience of Google Pay. WeChat Pay’s widespread popularity and Facebook Messenger Payments’ simplicity also make them excellent choices.

If you frequently use mobile payment apps like Google Pay or Apple Pay, it’s essential to prioritize security. Additionally, understanding the differences between PayPal and Venmo can help you make informed choices for your transactions.

In this digital age, choosing the right payment platform ensures that you can share moments and support loved ones, no matter where they are in the world.