Introduction

As concerns about climate change and environmental sustainability grow, many people are turning to plant-based diets as a way to reduce their impact on the planet. But what exactly makes plant-based eating so eco-friendly? From reducing greenhouse gas emissions to conserving water and protecting biodiversity, the benefits of plant-based diets for the planet are undeniable. Whether you’re a seasoned vegan or simply curious about sustainable eating, this article will explore how choosing plant-based foods can help protect the environment. By the end, you’ll have a clearer understanding of how your dietary choices can make a difference—and why plant-based eating is a powerful tool for a healthier planet.

What is a Plant-Based Diet?

A plant-based diet is made up mostly of foods from plants. This includes vegetables, fruits, grains, nuts, and legumes like beans. Some people may cut out all animal products like meat, milk, and eggs, while others may just reduce how much they eat. The key idea is to eat more plant foods, which have a smaller impact on the planet than animal-based foods.

How Animal Farming Hurts the Environment

Farming animals for meat, milk, and eggs is a big reason why our planet is facing problems like climate change, water pollution, and the loss of forests. Raising animals needs a lot of land, water, and energy. For example, it takes around 1,800 gallons of water to produce just one pound of beef, but only 34 gallons are needed for the same amount of lentils. Raising livestock also creates harmful gases, like methane, which contribute to global warming.

When people switch to plant-based diets, they help reduce the demand for animal products, which can lead to less harm to the environment.

Benefits of Plant-Based Diets for the Planet

1. Reduced Greenhouse Gas Emissions

Tip: Animal agriculture is a major contributor to greenhouse gas emissions. Plant-based diets significantly lower your carbon footprint.

Example: Producing a pound of beef generates 20 times more greenhouse gases than producing a pound of beans.

2. Water Conservation

Tip: Plant-based foods require far less water to produce compared to animal products.

Example: It takes about 1,800 gallons of water to produce one pound of beef, but only 39 gallons to produce a pound of vegetables.

3. Preservation of Land and Biodiversity

Tip: Animal farming leads to deforestation and habitat destruction. Plant-based diets help preserve natural ecosystems.

Example: The Amazon rainforest is often cleared for cattle ranching, threatening countless species.

4. Reduced Pollution

Tip: Animal agriculture contributes to water and air pollution. Plant-based diets minimize these harmful effects.

Example: Manure runoff from farms can contaminate water sources, while plant-based farming has a much lower pollution footprint.

5. Energy Efficiency

Tip: Producing plant-based foods is more energy-efficient than raising livestock.

Example: Growing crops like grains and legumes uses less energy than feeding and housing animals.

Easy Ways to Start Eating More Plant-Based

Switching to a plant-based diet doesn’t have to be hard. Here are a few simple ways to get started:

- Try Meatless Days: Start by having one or two meatless days a week. For example, you could try Meatless Mondays. This can help you slowly transition to eating more plant-based foods.

- Eat More Plant Protein: Foods like beans, lentils, tofu, and quinoa are great sources of protein. Try replacing meat with these plant-based options in your meals.

- Choose Whole Foods: Focus on eating whole grains, vegetables, fruits, and legumes. These foods are better for your health and the environment than processed plant-based foods.

- Support Sustainable Brands: Look for brands that use eco-friendly packaging or source their ingredients responsibly. These brands are better for the environment.

- Learn About the Impact of Your Food: Educating yourself about where your food comes from and how it affects the planet can help you make better choices. Every small change counts!

Growing Awareness About Plant-Based Diets

More people are becoming aware of the benefits of plant-based diets. This awareness is spreading through social media, documentaries, and discussions in the news. As people learn about the impact that food choices have on the environment, many are making the switch to plant-based eating. This growing knowledge is encouraging others to try eating more plants and fewer animal products.

Health Benefits of Eating More Plants

Eating more plant-based foods is not only good for the environment but also great for our health. Studies show that plant-based diets can reduce the risk of chronic diseases like heart disease, diabetes, and some cancers. Plants are full of vitamins, minerals, and fiber, which are important for our bodies. By choosing fruits, vegetables, and whole grains, we can feel better and improve our overall health.

How Plant-Based Diets Help the Planet

The way we produce food has a big impact on the planet. Animal farming uses a lot of land, water, and energy, while also creating greenhouse gases. By shifting to plant-based diets, we reduce the need for large-scale animal farming. This helps reduce pollution, saves water, and cuts down on the land needed for farming. Plant-based eating supports a healthier planet for future generations.

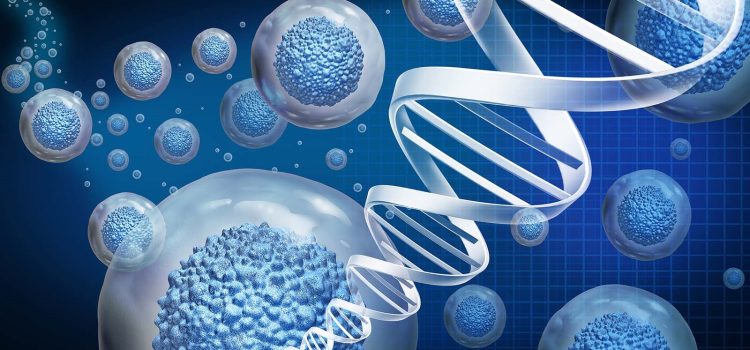

The Role of Technology in Plant-Based Eating

Technology is making it easier to follow a plant-based diet. Companies are creating more plant-based food products, like plant-based burgers and milk. This innovation makes it easier for people to enjoy familiar foods without using animal products. Technology is also helping farmers grow crops in more sustainable ways, reducing the environmental impact of food production. As technology continues to improve, plant-based eating will become even more accessible and convenient.

The Importance of Education in Sustainable Eating

Education plays a big role in helping people make better food choices. When people understand how their food affects the environment, they are more likely to make changes. Schools, social media, and environmental groups are all working to teach the public about the benefits of eating plant-based. The more we learn, the easier it becomes to adopt sustainable eating habits and make healthier, more eco-friendly choices.

Supporting Local and Sustainable Agriculture

One way to make plant-based eating even better for the planet is by supporting local farmers. Many local farms use more sustainable farming practices that are better for the environment. By buying locally grown plants, we can reduce the carbon footprint of transporting food long distances. Supporting small-scale, sustainable farms also helps strengthen local economies and ensures that our food is grown in ways that protect the environment.

Plant-Based Diets and Animal Welfare

Choosing a plant-based diet is not only good for the environment and our health, but it also helps animals. By eating fewer animal products, we reduce the demand for factory farming, which often treats animals poorly. Many people choose plant-based eating to protect animal rights and ensure that animals are not harmed for food. A plant-based lifestyle is a way to show compassion toward animals while still enjoying tasty, nutritious meals.

Reducing Food Waste with Plant-Based Diets

Plant-based diets can also help reduce food waste. In many cases, plant-based foods are less likely to go to waste than animal products. This is because fruits, vegetables, and grains are often easier to store and use in multiple meals. By planning meals better and using leftovers, we can cut down on the amount of food that gets thrown away. Eating more plant-based foods encourages us to be more mindful of what we eat and how much we waste.

Affordable and Accessible Plant-Based Foods

Plant-based foods can be affordable and easy to find, especially if you shop locally. Many basic plant foods like beans, rice, lentils, and oats are inexpensive and can be used in a variety of dishes. Some people may worry that plant-based foods are expensive, but with careful planning, it’s possible to eat sustainably without spending too much. Farmers’ markets and local food co-ops also offer fresh, affordable plant-based options that are good for both you and the planet.

Challenges of Adopting a Plant-Based Diet

While plant-based diets are great for the planet, they can come with challenges. For example, some people find it hard to give up meat or dairy, especially if they’ve grown up eating them regularly. There can also be a lack of options in some areas, making it harder to follow a plant-based diet. Additionally, not everyone is aware of how important it is to choose eco-friendly food options. However, as demand grows, more products and resources are becoming available to make the switch easier.

The Future of Plant-Based Diets

The future of plant-based diets looks bright. As more people learn about the benefits for health and the environment, the trend is likely to grow. The food industry is already responding, with more plant-based options on the market. In the future, we may see even more sustainable food choices and greater awareness about how our food affects the planet. Eating plant-based will likely become a normal part of everyday life for more people as we work together to create a healthier, more sustainable world.

Comparing the Environmental Impact: Plant-Based vs. Animal-Based Diets

To see the differences between plant-based and animal-based diets, let’s compare their environmental impact. The table below shows how much land, water, and energy each type of diet uses:

| Environmental Factor | Plant-Based Foods | Animal-Based Foods |

|---|---|---|

| Water Usage (per lb of product) | 34-200 gallons | 1,800-2,500 gallons |

| Greenhouse Gas Emissions | Low | High (14.5% of global emissions) |

| Land Use (per lb of product) | 0.1-0.5 acres | 2-10 acres |

| Deforestation Risk | Low | High (especially for beef and palm oil) |

| Soil Degradation | Low | High |

| Pollution Risk | Low | High (manure and runoff) |

As you can see, plant-based foods have a much smaller environmental footprint than animal-based foods. From water use to pollution, plant-based diets are better for the planet in many ways.

Conclusion

Switching to a plant-based diet is one of the most impactful choices you can make for the planet. By reducing greenhouse gas emissions, conserving water, preserving land and biodiversity, and minimizing pollution, plant-based eating offers a sustainable solution to many of the environmental challenges we face today. While transitioning to a fully plant-based diet may seem daunting, even small changes—like incorporating more plant-based meals into your routine can make a significant difference. Together, we can create a healthier, more sustainable future for our planet. So, why not start today? Your plate has the power to change the world.

Call to Action

Have you tried a plant-based diet? Share your experiences or favorite plant-based recipes in the comments below, and don’t forget to subscribe for more tips on sustainable living!