Introduction

In a strategic maneuver that has sent shockwaves through the real estate industry, Redfin, a major online real estate player, has chosen to break away from the Realtor Group. This bold move is set to redefine the power dynamics in real estate, triggering discussions among real estate professionals, buyers, sellers, and industry observers. In this comprehensive article, we will delve into the details of Redfin’s exit, the driving forces behind this strategic decision, and the profound implications it holds for the Realtor Group and the broader real estate landscape.

The Rise of Redfin

To fully grasp the significance of Redfin’s departure, it is essential to recognize the ascent of this online real estate giant.

Founded in 2004, Redfin disrupted the traditional real estate model with its innovative online platform. Offering users an intuitive interface, transparent pricing, and an extensive database of property listings, Redfin rapidly gained prominence, challenging the dominance of brick-and-mortar real estate agencies and capturing a significant market share.

Redfin’s Exit: Unpacking the Strategy

Redfin’s decision to leave the Realtor Group has left the real estate community and industry observers pondering the motivations and strategy behind this groundbreaking move. To gain insights into the driving factors, we must consider a series of critical elements:

Market Dynamics

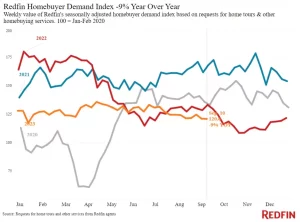

- Redfin faced intensified competition from other tech-driven real estate platforms, resulting in a gradual erosion of its market share.

- The real estate market experienced fluctuations and uncertainties, including supply shortages and fluctuating interest rates, which adversely impacted Redfin’s financial performance.

Business Model Challenges

- Sustaining a large team of in-house agents became increasingly financially unsustainable, especially as operational costs rose.

- Redfin’s “iBuyer” program, involving the direct purchase and resale of homes from sellers, faced operational challenges and profitability issues.

Evolving Industry Landscape

- Regulatory changes, including shifts in licensing requirements for real estate agents, introduced obstacles to Redfin’s business model.

- The COVID-19 pandemic accelerated changes in the real estate industry, hastening the transition toward digital adoption, a transition that may not have been seamless for Redfin’s existing operations.

Implications for the Realtor Group, Buyers, and Sellers

Redfin’s exit from the Realtor Group carries significant implications for all stakeholders within the real estate ecosystem:

Realtor Group

- Altered Competitive Landscape: The departure of Redfin is likely to alter the competitive dynamics within the Realtor Group, ushering in new challenges and opportunities.

- Adaptation to Consumer Preferences: Realtor groups will need to adapt to evolving consumer preferences, which may include a resurgence in demand for traditional real estate services.

Buyers

- Changes in Online Resources: With Redfin’s exit, buyers may witness alterations in the availability of online resources for property searches, potentially impacting their home-buying experiences.

- Pricing Influence: The absence of Redfin’s proprietary pricing tools may affect buyers’ ability to assess property values effectively.

Sellers

- Listing Exposure: Sellers may experience shifts in listing exposure, potentially influencing the speed at which their properties sell.

- Pricing Strategies: The absence of Redfin’s pricing algorithms may impact sellers’ pricing strategies and negotiation positions.

Image by: https://files .word press.com

Redefining the Real Estate Landscape

Redfin’s exit has set in motion a significant redefinition within the real estate sector:

Emerging Players

- Other tech-driven real estate platforms are likely to step in and fill the void left by Redfin, continuing the trend toward online real estate transactions.

- New entrants may seek to capitalize on evolving market dynamics and consumer preferences.

Traditional Realtors

- Traditional real estate agencies may experience a resurgence in demand as consumers seek experienced agents for guidance and support.

- The expertise and local knowledge offered by traditional Realtors may regain prominence in the eyes of buyers and sellers.

Consumer Choice

- Buyers and sellers now have more choices than ever before, ranging from traditional agents to a diverse array of online platforms.

- This increased choice ensures a competitive and dynamic real estate market, empowering consumers to select services that align with their individual needs and preferences.

Conclusion

Redfin’s departure from the Realtor Group represents a power play that is poised to redefine the dynamics of real estate. While the company’s innovative approach had a profound impact on the sector, its challenges and ultimate exit underscore the dynamic and ever-evolving nature of the real estate market.

As the real estate landscape continues to evolve, the Realtor Group, buyers, sellers, and industry professionals must adapt to these changes and explore new opportunities within this dynamic environment. Whether it’s the rise of emerging online platforms, the enduring strength of traditional Realtors, or the expanding choices available to consumers, one thing is clear: the real estate industry is undergoing transformation, and those who navigate these changes effectively will thrive in this reshaped landscape.