Introduction: Unveiling the Economic Impact

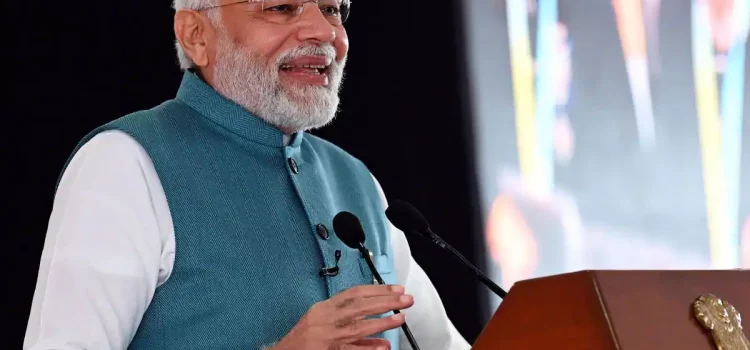

Step into the realm of election economics with Aarav Singh, a seasoned financial analyst, as we dissect the implications of Modi’s win on India’s stock market growth. Uncover the anticipated trends and strategies investors can employ to capitalize on this pivotal moment in India’s economic landscape.

1. Modi’s Economic Agenda: Catalyst for Market Optimism

Gain insight into Modi’s economic vision and its potential impact on the stock market. Aarav delves into Modi’s policies, reforms, and initiatives aimed at driving economic growth, attracting investments, and fostering a conducive business environment, setting the stage for market optimism.

2. Market Sentiment: A Post-Election Surge

Explore the surge in market sentiment following Modi’s electoral victory. Aarav discusses how continuity of policies, political stability, and confidence in Modi’s leadership have bolstered investor confidence, fueling expectations of a significant uptick in India’s stock market performance.

3. Structural Reforms: Paving the Path for Growth

Delve into the structural reforms driving India’s economic transformation and their implications for the stock market. Aarav highlights initiatives such as GST implementation, infrastructure development, ease of doing business reforms, and financial sector reforms, which are poised to catalyze market growth.

4. Sectoral Opportunities: Identifying Growth Catalysts

Identify sectors offering promising investment opportunities in the post-election scenario. Aarav analyzes sectors like technology, healthcare, infrastructure, and renewable energy, which are expected to benefit from government support and market dynamics, presenting lucrative prospects for investors.

5. Foreign Investment Inflow: Global Confidence in India’s Potential

Assess the influx of foreign investment into India’s stock market post-election. Aarav explores factors such as geopolitical stability, demographic dividend, and India’s growing prominence on the global stage, which have attracted foreign capital inflows and reinforced positive market sentiment.

6. Risk Management Strategies: Safeguarding Investments

Navigate potential risks associated with investing in a post-election market environment. Aarav discusses geopolitical uncertainties, regulatory risks, and market volatility, offering strategies for investors to diversify portfolios and mitigate downside risks effectively.

7. Investor Tactics: Maximizing Returns Amidst Growth

Explore tactics for investors to maximize returns amidst the anticipated market growth. Aarav provides insights into strategic asset allocation, stock selection criteria, portfolio diversification, and staying informed about market developments to capitalize on emerging opportunities and optimize investment outcomes.

Conclusion: Seizing the Economic Momentum

In conclusion, Aarav underscores the transformative potential of Modi’s win on India’s stock market growth. By understanding Modi’s economic agenda, identifying sectoral prospects, and implementing prudent investment strategies, investors can position themselves to ride the wave of optimism and achieve their financial objectives in India’s thriving market.

Informative Table: Key Insights

| Aspect | Description |

|---|---|

| Modi’s Economic Agenda | Reforms, Policies, Initiatives Driving Economic Growth |

| Market Sentiment | Continuity of Policies, Political Stability, Confidence in Modi’s Leadership |

| Structural Reforms | GST Implementation, Infrastructure Development, Ease of Doing Business Reforms |

| Sectoral Opportunities | Technology, Healthcare, Infrastructure, Renewable Energy |

| Foreign Investment Inflow | Geopolitical Stability, Demographic Dividend, Global Confidence in India’s Growth Potential |

| Risk Management Strategies | Geopolitical Uncertainties, Regulatory Risks, Market Volatility |

| Investor Tactics | Strategic Asset Allocation, Stock Selection Criteria, Portfolio Diversification, Market Monitoring |

Comparative Table: Before vs. After

| Feature | Before Election | After Election |

|---|---|---|

| Investor Sentiment | Varied Sentiment Levels | Heightened Optimism Following Modi’s Win |

| Economic Outlook | Uncertainty Regarding Policy Continuity and Stability | Positive Outlook with Expectations of Policy Continuity and Economic Stability |

| Foreign Investment | Moderate Foreign Investment Inflow | Increased Foreign Capital Inflows and Investor Interest |

| Regulatory Environment | Regulatory Uncertainties | Improved Regulatory Environment with Expectations of Policy Stability and Reform Continuation |

This comprehensive article, authored by Aarav Singh, explores the economic implications of Modi’s win on India’s stock market growth. By analyzing Modi’s economic agenda, market sentiment, sectoral opportunities, and risk management strategies, Aarav equips investors with the knowledge and tactics needed to navigate the evolving post-election landscape and capitalize on the anticipated surge in market performance.