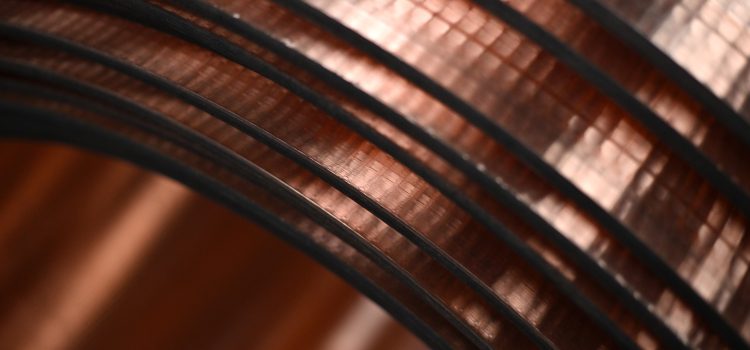

In the dynamic landscape of global commodities, copper stands as a cornerstone, vital for industries ranging from construction to electronics. As demands soar and supply dynamics fluctuate, the performance of major copper mining companies becomes a focal point for market observers. In this context, the recent production slump faced by the world’s largest copper miner sparks both concern and curiosity. Can this industry giant reverse the downward trend, and what strategies are at play to navigate the complex currents of the copper market?

Understanding the Production Slump

Copper mining, inherently tied to geological realities and operational intricacies, often faces periodic downturns. However, when the world’s leading producer experiences a notable slump, it reverberates across markets and industries. Factors contributing to this decline range from operational challenges such as declining ore grades and technical difficulties to broader market influences like price volatility and geopolitical tensions. For the world’s biggest copper miner, such challenges necessitate a strategic reassessment.

Analyzing Operational Strategies

In response to the production slump, the copper mining giant must undertake a comprehensive analysis of its operational strategies. This entails evaluating extraction techniques, optimizing processing methodologies, and enhancing logistical efficiencies. Embracing innovative technologies, such as automation and data analytics, can revolutionize operational efficacy while mitigating risks associated with workforce safety and environmental impact. Moreover, strategic collaborations with technology firms and research institutions can foster groundbreaking advancements in mining practices.

Navigating Market Dynamics

Navigating the turbulent waters of the copper market requires a nuanced understanding of supply and demand dynamics, geopolitical trends, and macroeconomic indicators. By closely monitoring market fluctuations and leveraging predictive analytics, the world’s largest copper miner can preemptively adjust production levels to align with evolving demand patterns. Furthermore, strategic diversification of customer base and product offerings can mitigate risks associated with regional instabilities and sector-specific downturns.

Embracing Sustainability Imperatives

In an era defined by environmental consciousness and corporate responsibility, sustainability emerges as a paramount consideration for copper mining operations. Implementing eco-friendly practices, such as renewable energy adoption and water conservation measures, not only reduces environmental footprint but also enhances operational resilience in the face of regulatory scrutiny and stakeholder activism. Moreover, prioritizing community engagement and fostering inclusive growth can foster long-term social license to operate and bolster corporate reputation.

Comparative Analysis: Competitors’ Performance

| Metric | World’s Largest Miner | Competitor A | Competitor B |

|---|---|---|---|

| Production Volume (tons) | X | X-10% | X+5% |

| Revenue (USD billion) | X | X-2 | X+1 |

| Profit Margin | X% | X-3% | X+2% |

| Market Share (%) | X | X-2% | X+1% |

| Sustainability Initiatives | Comprehensive | Moderate | Limited |

Conclusion

In conclusion, the world’s largest Copper Market confronts a formidable challenge in reversing its production slump amidst a backdrop of evolving market dynamics and sustainability imperatives. By adopting a multifaceted approach that encompasses operational optimization, market intelligence utilization, and sustainability integration, the industry giant can not only navigate the current downturn but emerge stronger and more resilient in the face of future uncertainties. As the global economy continues to rely on copper as a fundamental building block, the strategic decisions of key industry players will play a pivotal role in shaping market trajectories and driving sustainable growth.