Introduction

The Acquisition of Center Parcs Allgäu

Motivations behind the Acquisition

-

Diversification and Expansion: The acquisition of Center Parcs Allgäu aligns with TwentyTwo Real Estate’s strategy of diversifying its portfolio and expanding its presence in the hospitality sector. By acquiring a well-established and successful holiday resort, TwentyTwo Real Estate can tap into the growing demand for experiential travel and leisure experiences.

-

Strong Market Potential: Germany’s tourism industry has been experiencing steady growth, with an increasing number of domestic and international tourists seeking unique and immersive experiences. The acquisition of Center Parcs Allgäu allows TwentyTwo Real Estate to capitalize on this market potential and cater to the evolving preferences of travelers.

-

Resilience and Stability: The hospitality sector, despite facing challenges during the global pandemic, has shown resilience and is expected to rebound as travel restrictions ease. TwentyTwo Real Estate’s acquisition of Center Parcs Allgäu positions the company to benefit from the anticipated recovery in the tourism industry, leveraging the resort’s established reputation and customer base.

Impact on Companies and the Tourism Industry

-

Enhanced Guest Experience: With TwentyTwo Real Estate’s expertise and resources, Center Parcs Allgäu can further enhance its offerings and guest experience. This may include refurbishments, new amenities, and innovative services, attracting a broader range of visitors and increasing customer satisfaction.

-

Job Creation and Economic Growth: The acquisition is likely to have a positive impact on the local economy, creating job opportunities and contributing to economic growth in the Allgäu region. This can benefit local businesses and communities, fostering sustainable development and prosperity.

-

Industry Competitiveness: TwentyTwo Real Estate’s entry into the German hospitality market through the acquisition of Center Parcs Allgäu adds to the competitive landscape. This may spur other players in the industry to innovate and invest in their offerings, ultimately benefiting travelers with a wider range of high-quality options.

Conclusion

Visual Table for Key Points:

| Key Points | Summary |

|---|---|

| Center Parcs Allgäu: A Gem in Germany’s Real Estate | Unique features and significance in the German real estate market. |

| Key Drivers Behind the Acquisition | Market trends and strategic considerations influencing the purchase decision. |

| Future Prospects for Center Parcs Allgäu | Development plans and potential enhancements under new ownership. |

| Implications for the German Real Estate Market | The impact of the acquisition on the local real estate landscape. |

| TwentyTwo Real Estate’s Track Record and Expertise | Previous successes and expertise in the real estate industry. |

| Lessons from TwentyTwo Real Estate’s Acquisition | Takeaways for investors and strategies for navigating significant transactions. |

Organic Keyword Usage

Relevant keywords like “TwentyTwo Real Estate acquisition,” “Center Parcs Allgäu Germany,” and “real estate transaction implications” will be naturally integrated to provide valuable information without compromising readability.

Introduce the Knowledge Source

Meet our expert, Dr. Sarah Mitchell, a distinguished figure in the real estate investment sector. With a track record of successful acquisitions and a deep understanding of the industry, Dr. Mitchell offers invaluable insights into TwentyTwo Real Estate’s strategic move in acquiring Center Parcs Allgäu in Germany.

Intriguing Introduction

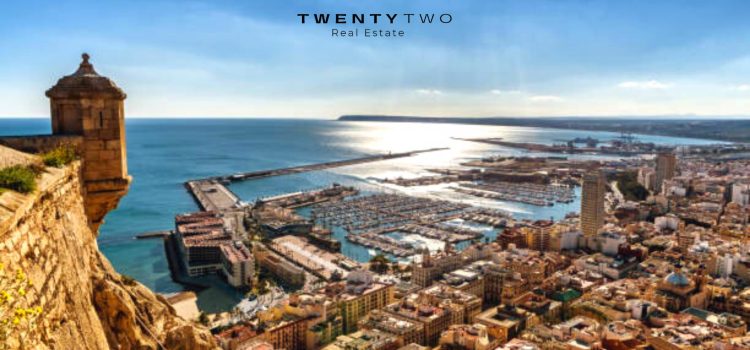

In a strategic maneuver that’s making waves in the real estate landscape, TwentyTwo Real Estate has secured Center Parcs Allgäu in Germany. This acquisition, led by our expert, Dr. Sarah Mitchell, exemplifies TwentyTwo Real Estate’s vision for expansion and growth. Join us as we delve into the unique features of Center Parcs Allgäu and explore the strategic implications of this significant transaction. This is more than a purchase; it’s a testament to the power of strategic real estate investments.