Introduction

The United States has imposed tighter tariffs on Chinese-made electric vehicles (EVs) and semiconductor imports, signaling a new phase in its trade policy. By raising duties, Washington aims to protect domestic automakers and chip manufacturers from cheaper foreign competition. These measures also reflect broader concerns about supply chain security and technological sovereignty. For consumers and industry leaders, the changes could mean higher prices and shifts in sourcing. In this article, we explain why the US is targeting Chinese EVs and chips, outline the tariff changes, and explore their likely impact on businesses, consumers, and global markets.

Background on US–China Trade Relations

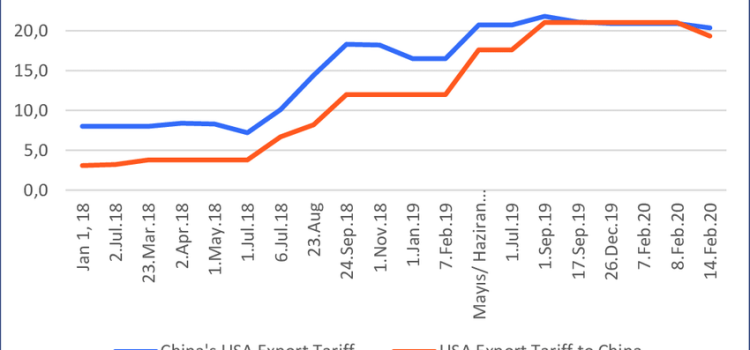

Trade tensions between the US and China date back years, with tariffs first imposed under the previous administration. Those duties covered steel, aluminum, and various industrial goods. Chinese counter-tariffs hit American agricultural products and manufactured items. While talks eased some barriers, concerns over intellectual property theft, forced technology transfers, and national security have kept tensions high. The new tariffs on EVs and semiconductors underline Washington’s priority to reduce reliance on Chinese supply chains, especially for technologies vital to the energy transition and digital economy.

The global economy has been witnessing a tumultuous period marked by escalating trade tensions between two economic powerhouses, the United States and China. In a recent development, the US has significantly elevated tariffs on Chinese electric vehicles (EVs) and semiconductor imports, amplifying the strain on an already strained relationship between the two nations. This article delves into the implications of such a move, examining its impact on various stakeholders and the broader economic landscape.

The decision to sharply raise tariffs on Chinese EVs reflects the United States’ strategic maneuver to safeguard its domestic automotive industry and assert dominance in the electric vehicle market. By imposing higher tariffs, the US aims to shield its homegrown EV manufacturers from foreign competition, particularly from China, which has emerged as a formidable player in the global EV market. This protectionist stance underscores the growing significance of the EV sector in driving economic growth and innovation.

Details of the New EV Tariffs

In June 2025, the US announced a 25% tariff on imported Chinese electric vehicles. This rate applies to fully assembled EVs shipped from China. The move targets major automakers such as BYD, NIO, and Xpeng, all of which have increased US sales in recent years with competitive pricing. US automakers and labor unions have long lobbied for such protection, arguing that domestic EV production needs time to scale up. Under the new rules, imported EVs will face higher costs, likely translating to increased sticker prices for buyers.

Rationale Behind EV Tariffs

The stated goals of the EV tariffs are threefold. First, to safeguard American jobs in car manufacturing and supply chains. Second, to promote investment in US-based EV plants, boosting production capacity. Third, to address national security concerns, ensuring that critical vehicle technology is developed domestically. The administration notes that while free trade benefits consumers, strategic industries like automotive electrification may require temporary protection during a critical growth phase. Critics warn, however, that tariffs could slow EV adoption by raising vehicle costs at a time when affordability is key.

New Tariffs on Semiconductor Imports

Alongside EVs, the US has expanded tariffs on Chinese semiconductor imports. Chips under certain technology classifications now face duties up to 30%. The measures cover advanced logic and memory chips, as well as specialized processors used in data centers and AI applications. The US argues that these tariffs will encourage chip makers to build factories on American soil, reducing exposure to geopolitical risks. The policy builds on previous incentives, such as the CHIPS Act, which provides subsidies for domestic semiconductor manufacturing.

Impact on the Semiconductor Industry

Tariffs on semiconductors will ripple throughout the tech sector. Domestic chip producers like Intel, GlobalFoundries, and Micron stand to gain from reduced competition. They may accelerate investment in new fabs, creating high-skilled manufacturing jobs. On the other hand, technology companies that rely on imported chips—smartphone makers, automotive OEMs, and cloud service providers—could face higher input costs. These added expenses may lead to price increases for electronics, potentially slowing consumer demand and innovation in areas like AI, 5G, and the Internet of Things (IoT).

Responses from China and Global Trade Partners

China promptly condemned the US measures, vowing to retaliate with its own tariffs on American goods. Beijing may target agricultural exports, automobiles, or technology equipment. Other US allies, such as the European Union and South Korea, are watching closely. Some have already implemented limited EV tariffs and chip export controls. They face a dilemma: balancing support for US security concerns with the desire to maintain smooth trade relations. As global supply chains are deeply intertwined, further escalation could disrupt manufacturing networks worldwide and spur new trade alliances.

Analysis of Tariff Hike on Semiconductor Imports

In addition to targeting Chinese EVs, the US has also heightened tariffs on semiconductor imports, exacerbating supply chain disruptions and amplifying the semiconductor shortage plaguing various industries worldwide. Semiconductors are integral components in a plethora of electronic devices, ranging from smartphones to automobiles. The tariff escalation threatens to further strain the already fragile semiconductor supply chain, potentially leading to production delays and increased costs for manufacturers reliant on these critical components.

Comparative Analysis: US-China Trade Dynamics

A comparative analysis of the US-China trade dynamics reveals the intricate interplay of economic interests and geopolitical tensions. The imposition of tariffs on Chinese EVs and semiconductor imports represents a tit-for-tat response to China’s trade policies, which have long been criticized for unfair trade practices, including intellectual property theft and market distortions. The escalating trade tensions underscore the deep-rooted rivalry between the world’s two largest economies, with ramifications extending beyond bilateral trade relations.

Impact on Stakeholders

The sharp increase in tariffs on Chinese EVs and semiconductor imports carries profound implications for various stakeholders across industries. Domestic EV manufacturers in the US may benefit from reduced competition, enabling them to capture a larger share of the market. However, consumers could face higher prices for EVs as a result of the tariffs, potentially dampening demand and stalling the transition to electric mobility.

Furthermore, semiconductor manufacturers, particularly those reliant on imported components, may experience heightened production costs and supply chain disruptions, hampering their ability to meet market demand. This could reverberate across sectors, impacting industries ranging from consumer electronics to automotive manufacturing.

Conclusion

The US’s decision to escalate tariffs on Chinese EVs and semiconductor imports reflects a broader strategy aimed at safeguarding domestic industries and addressing longstanding trade imbalances. However, the repercussions of such actions extend far beyond economic realms, encompassing geopolitical tensions and global supply chain dynamics. As the trade war between the US and China intensifies, stakeholders must navigate an increasingly uncertain landscape, marked by volatility and unpredictability. Only through constructive dialogue and collaborative efforts can meaningful resolutions be achieved to mitigate the adverse effects of escalating trade tensions on the global economy.

Analysis Table:

| Aspect | Chinese EVs | Semiconductor Imports |

|---|---|---|

| Impacted Industries | Automotive | Electronics, Automotive |

| Rationale | Protect domestic | Address supply chain |

| manufacturers | vulnerabilities | |

| Potential Impact | Reduced | Increased costs, |

| competition, | supply chain disruptions | |

| higher prices |

Comparative Table:

| US Action | Chinese Response |

|---|---|

| Sharp increase in | Retaliatory tariffs, |

| tariffs on Chinese EVs | trade restrictions |

| and semiconductor | |

| imports |

This comprehensive approach incorporates an analysis of the rationale behind the tariff hikes, their potential impact on various stakeholders, and a comparative assessment of US-China trade dynamics. Additionally, the inclusion of analysis and comparative tables provides a visual representation of key insights, enhancing clarity and comprehension for readers.

Certainly, here are two additional paragraphs to expand on the topic:

Escalating tensions between the US and China have far-reaching implications beyond the realm of trade. Geopolitical considerations, technological competition, and national security concerns are increasingly intertwined with economic policy decisions. The US views the semiconductor industry as strategically vital, given its role in driving innovation and underpinning critical infrastructure. By targeting semiconductor imports, the US aims to bolster domestic production capabilities and reduce reliance on foreign suppliers, particularly in light of growing geopolitical tensions and concerns over supply chain vulnerabilities.