Introduction

The rise of social media and 24/7 online connectivity has transformed how the world views and interacts with celebrities. While fans have greater access to their favorite stars, this unprecedented connectivity also creates challenges for maintaining personal privacy. This article explores the evolution of celebrities’ privacy in the digital era, analyzing the challenges, strategies, and the balance between public persona and private life.

The Rise of Celebrities’ Privacy Issues in the Digital Age

With the growth of the internet and social media, celebrities’ privacy has become a major concern. In the past, their private lives were more protected, but now, everyone can share pictures and information instantly. This rise of digital media has made it harder for celebrities to keep their personal lives private.

How the Digital Age Changed Celebrity Privacy

1. The Pre-Digital Era: Controlled Narratives

Before the advent of the internet, celebrity image management was handled by publicists and limited media channels like print, radio, and television. Celebrities controlled much of their narrative, appearing in interviews, films, or magazines on their terms.

2. The Internet Boom: A Turning Point

The late 1990s and early 2000s saw the emergence of the internet as a global communication tool. Online fan forums and paparazzi-driven websites began encroaching on celebrities’ private lives. The shift gave the public an illusion of intimacy with celebrities.

3. Social Media Revolution

Platforms like Instagram, Twitter, and TikTok enable celebrities to connect with millions instantly. However, the same platforms also serve as spaces for intense scrutiny. Unfiltered posts, leaks, and public interactions often blur the line between public and private life.

Benefits of Protecting Celebrities’ Privacy

Protecting their privacy allows celebrities to lead healthier, stress-free lives. It gives them the space to enjoy personal moments without the constant pressure from the public and media. Keeping a boundary between their work and personal life helps them stay grounded and focused on what matters most.

The Role of Celebrities in Managing Their Privacy

Celebrities play a big role in managing their privacy. They decide what to share on social media and use legal tools like privacy laws and agreements to protect themselves. They also choose how much of their personal life they want to show the world, balancing openness with privacy.

The Impact of Social Media on Celebrity Privacy

Social media has changed how we interact with celebrities. Platforms like Instagram, Twitter, and TikTok let fans see parts of their lives that were once private. While it allows fans to feel closer to celebrities, it also makes it harder for them to keep personal moments out of the spotlight. Celebrities often feel pressure to post and stay active online, which can lead to the loss of their privacy.

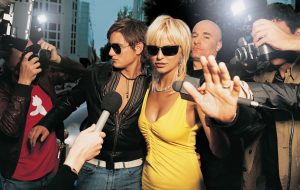

How Paparazzi Affect Celebrities’ Privacy

Paparazzi, or photographers who take pictures of celebrities without their permission, are a big problem. With smartphones and cameras everywhere, celebrities can never fully escape attention. These photographers often follow celebrities everywhere, from vacations to everyday activities, invading their personal space. This can be very stressful for celebrities who just want to live normal lives.

Legal Protections for Celebrities’ Privacy

Celebrities have some legal tools to protect their privacy. Laws about defamation, harassment, and invasion of privacy help prevent unwanted attention. Celebrities can also file lawsuits if their personal information is shared without consent. Though these laws offer some protection, they don’t always prevent leaks or unwanted media coverage.

The Balance Between Public and Private Life

Celebrities often struggle with finding a balance between their public life and private life. On one hand, they need to share parts of their personal life to stay connected with fans and build their image. On the other hand, they want to keep certain moments private for their own well-being. This balance can be difficult to maintain as fans demand more and more access.

Fans and the Right to Know

Fans feel a strong connection to celebrities and often want to know everything about their lives. This can lead to pressure on celebrities to share more than they’re comfortable with. While many fans respect boundaries, some feel entitled to know personal details. This “right to know” creates a constant tension between celebrity privacy and public curiosity.

Challenges to Celebrity Privacy in the Digital Era

The main challenge celebrities face is constant exposure. Paparazzi and social media can invade their private moments, leading to stress and public scrutiny. Cybersecurity threats and the pressure to share personal details online are other struggles that make it difficult for them to maintain privacy.

1. Invasive Paparazzi Culture

Digital cameras and smartphones have made it easier than ever to capture candid moments. Paparazzi culture thrives on real-time uploads to satisfy public curiosity, often crossing ethical boundaries.

2. Cybersecurity Threats

From hacked accounts to leaked private data, celebrities face increasing risks in the digital age. Cyberattacks have led to scandals and even legal battles over the violation of privacy.

3. Audience Expectations

Today’s audience often demands transparency, expecting celebrities to share personal aspects of their lives. This pressure to stay relevant can lead to oversharing, further eroding privacy.

The Pressure to Share Everything

In today’s world, fans expect celebrities to share almost every detail of their lives. Social media has created a culture where people feel connected to stars, leading to pressure for constant updates. Celebrities are often expected to post about their personal lives, relationships, and even daily routines. This pressure can make it hard for them to have privacy, and some might feel they have no choice but to share more than they want to.

The Role of Fans in Respecting Privacy

While many fans respect celebrities’ privacy, others push boundaries by seeking out personal information. Fans might try to track celebrities’ movements or share private moments without consent. Some fans may even invade their personal spaces, hoping to capture something that will go viral. This behavior can make it harder for celebrities to live freely, even if they don’t want to be in the spotlight all the time.

How Technology Invades Privacy

Advancements in technology have made it easier for people to invade celebrities’ privacy. Smartphones and drones can capture moments from anywhere, and websites often post rumors and photos without permission. This instant sharing makes it difficult for celebrities to control their image or keep certain aspects of their lives private. Technology is both a tool for connecting with fans and a threat to personal boundaries.

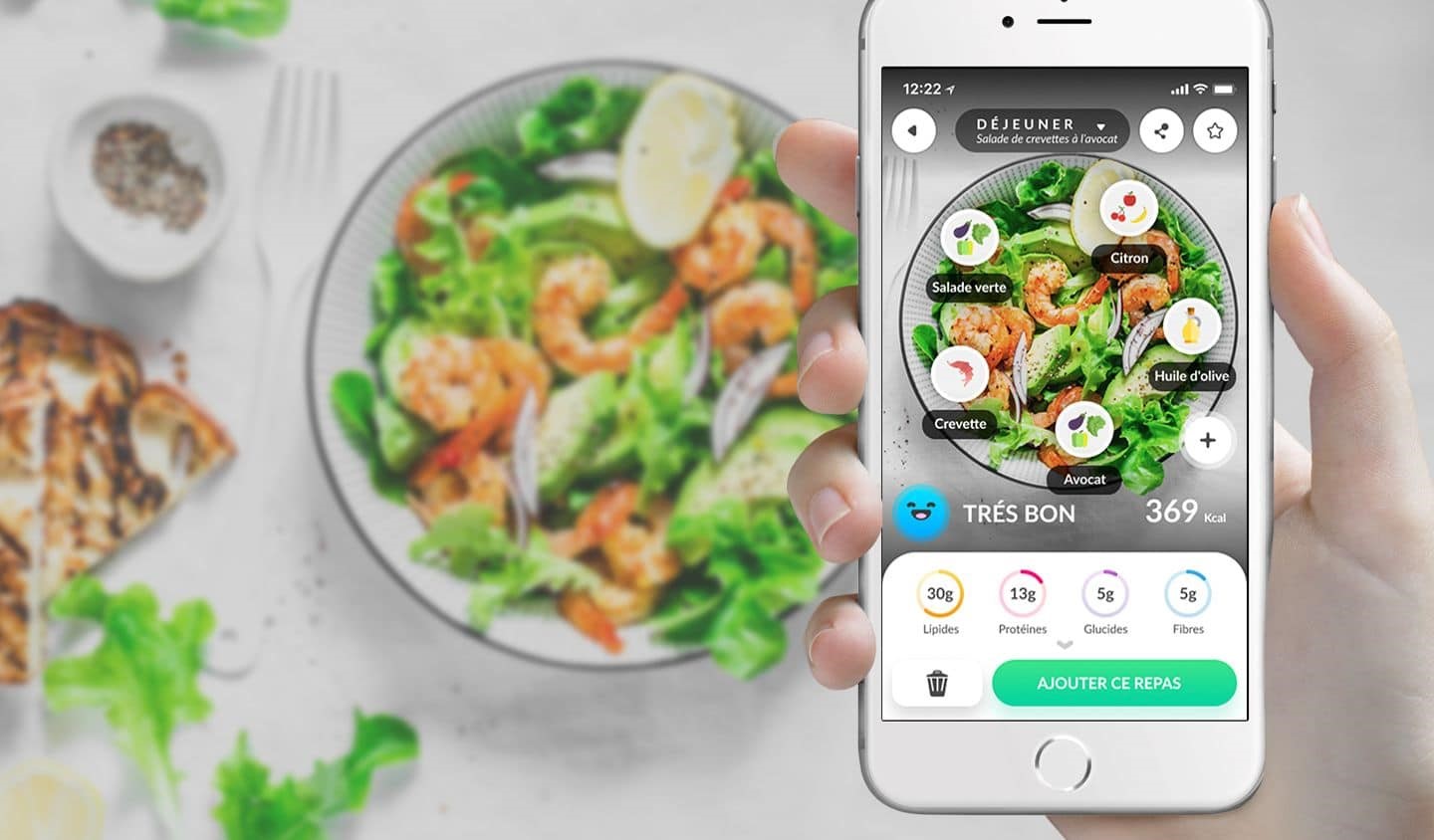

How Celebrities Use Social Media for Control

While social media can invade privacy, it also gives celebrities a way to take control of their image. Many stars use platforms like Instagram or Twitter to directly share news and updates with their followers. By controlling what they post, celebrities can shape how the public sees them. However, this doesn’t always stop others from posting rumors or untrue stories about them.

The Danger of Fake News and Misinformation

In the digital age, fake news and rumors spread quickly. Celebrities often find themselves the target of false stories or exaggerated headlines. These rumors can harm their reputation, cause stress, and invade their privacy. Sometimes, celebrities have to respond publicly to correct false information, which takes time and energy away from their personal lives. It’s an ongoing challenge to deal with misinformation in a world where news travels fast.

Mental Health and Privacy

The constant invasion of privacy can be harmful to celebrities’ mental health. The pressure to always be perfect and available for fans can lead to stress, anxiety, and burnout. Many celebrities speak out about how the loss of privacy has affected their well-being. Some have even taken breaks from social media or the public eye to protect their mental health and find peace away from the cameras

Strategies Celebrities Use to Protect Their Privacy

1. Limited Social Media Use

Many celebrities opt to maintain professional accounts that focus on their work rather than personal life, avoiding oversharing.

2. Legal Protections

Strict privacy laws, lawsuits, and non-disclosure agreements (NDAs) are commonly used by celebrities to protect themselves from privacy breaches.

3. Controlled Narratives

Some celebrities deliberately share curated glimpses of their lives to satisfy public curiosity while safeguarding their privacy.

4. Offline Escapes

Celebrities increasingly spend time in private, remote locations to avoid media attention and online scrutiny.

How Celebrities Set Boundaries Online

Many celebrities have learned to set clear boundaries online to protect their privacy. Some only share work-related posts, like new projects or events, while keeping personal matters private. Others take breaks from social media when they feel overwhelmed. By being selective about what they post, celebrities can control what the public sees, reducing the pressure to constantly share everything about their lives.

The Future of Celebrities’ Privacy in the Digital Age

In the future, celebrities may use advanced technology to control their privacy even better. They could use new privacy laws, stronger security measures, and more thoughtful social media practices to protect themselves. However, finding the right balance between staying connected with fans and maintaining privacy will always be a challenge.

Analysis Table: Celebrities’ Privacy Challenges and Solutions

| Challenge | Description | Potential Solution |

|---|---|---|

| Paparazzi Intrusion | Unwanted photos and stalking by photographers. | Stronger privacy laws and restricted zones. |

| Cybersecurity Risks | Hacking of accounts and personal information leaks. | Advanced cybersecurity measures and legal action. |

| Public Curiosity | Pressure to share personal details to remain relevant. | Setting clear boundaries on social platforms. |

| Online Misinformation | Spread of rumors or doctored content. | Immediate clarification through verified sources. |

Comparative Table: Privacy in the Pre-Digital vs. Digital Age

| Aspect | Pre-Digital Age | Digital Age |

|---|---|---|

| Media Exposure | Controlled by PR and limited channels. | Instant, global, and often uncontrolled. |

| Fan Interaction | Rare and mediated by events or fan clubs. | Direct and frequent via social media. |

| Privacy Intrusion | Minimal, mostly through tabloid journalism. | High, through paparazzi and online leaks. |

| Response Mechanism | Delayed and managed through PR. | Instantaneous via social media posts. |

Conclusion

The digital age has brought both opportunities and challenges for celebrities. While platforms allow for global influence and direct fan engagement, they have also eroded traditional privacy boundaries. Celebrities must now strike a balance between staying relevant and protecting their personal lives, utilizing legal measures, and adopting cautious online behavior.