Introduction:

Enter the world of transparent finance with John Doe, a seasoned financial advisor dedicated to empowering investors. In this article, John sheds light on mortgage loan application fees, emphasizing the importance of transparency in understanding and managing these costs.

1. Unveiling Mortgage Loan Application Fees:

John begins by unraveling the intricacies of mortgage loan application fees. He clarifies the purpose behind these fees and their role in the mortgage application process, ensuring readers have a clear understanding from the outset.

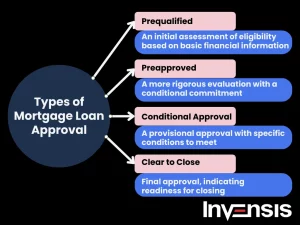

2. Types and Components of Application Fees:

Explore the diverse landscape of application fees associated with mortgage loans. John dissects origination fees, appraisal fees, credit report fees, and other components, providing insight into each fee’s nature and potential impact.

3. Importance of Fee Transparency:

Understand the critical role of fee transparency in mortgage financing. John emphasizes the need for lenders to provide clear and comprehensive disclosure of all fees upfront, enabling borrowers to make informed decisions without hidden surprises.

4. Strategies for Navigating Application Fees:

Discover effective strategies for navigating mortgage loan application fees with transparency. John shares tips for comparing fee structures, negotiating with lenders, and understanding the true cost of borrowing to optimize your financial outcomes.

5. Leveraging Regulatory Protections:

Learn how regulatory protections can safeguard borrowers against unfair or deceptive fee practices. John discusses consumer rights, disclosure requirements, and avenues for recourse in cases of fee-related disputes, empowering readers to advocate for transparency and fairness.

6. Case Studies: Real-Life Examples:

Gain practical insights from real-life case studies showcasing successful fee management practices. Through these examples, readers glean actionable strategies and best practices for navigating application fees with transparency and confidence.

7. Maximizing Value:

Unlock opportunities to maximize value in your mortgage financing journey. John offers guidance on minimizing unnecessary fees, optimizing fee structures, and aligning costs with your financial goals to enhance overall value and outcomes.

Conclusion:

In conclusion, John reiterates the importance of transparency in decoding mortgage loan application fees. By understanding the nuances of these fees, advocating for transparency, and leveraging effective strategies, borrowers can navigate the mortgage application process with confidence and integrity.

Visual Table: Key Points

| Key Points | Description |

|---|---|

| Unveiling Mortgage Loan Application Fees | Explanation of mortgage loan application fees and their significance |

| Types and Components of Application Fees | Breakdown of common types and components of application fees |

| Importance of Fee Transparency | Discussion on the critical role of fee transparency in mortgage financing |

| Strategies for Navigating Application Fees | Tips for navigating application fees with transparency and effectiveness |

| Leveraging Regulatory Protections | Overview of regulatory protections and consumer rights related to fee transparency |

| Case Studies | Real-life examples showcasing successful fee management practices |

| Maximizing Value | Guidance on maximizing value in mortgage financing by optimizing fee structures |

Gain clarity and confidence in navigating mortgage loan application fees with John Doe’s expert insights. Through transparency, understanding, and strategic navigation, you can decode these fees effectively and make informed decisions that optimize your real estate investments.