Introduction:

Embark on a journey of discovery with Mark Davis, a seasoned analyst at Relitix, as he unveils the subtle shifts in real estate agent dynamics observed during March. With a keen eye for market trends and data-driven insights, Mark delves into the findings that shed light on the changing dynamics within the real estate industry.

1. Overview of Real Estate Agent Dynamics:

Gain an understanding of the typical dynamics among real estate agents and their interactions within the market. Explore the roles they play, from property listings to client representation, and the factors influencing their strategies and decision-making processes.

2. Unveiling March’s Insights:

Discover the insights gleaned from Relitix’s analysis of real estate agent behavior and trends during the month of March. From shifts in listing strategies to changes in negotiation tactics, delve into the nuances that have emerged in response to evolving market conditions.

3. Adaptation to Market Trends:

Explore how real estate agents are adapting to emerging market trends and dynamics. Whether it’s leveraging digital marketing tools, adjusting pricing strategies, or reevaluating client preferences, learn how agents are staying agile in response to changing market forces.

4. Evolving Client Relationships:

Examine the evolving dynamics of client relationships in the real estate industry. From increased demand for virtual viewings to heightened expectations for personalized service, explore how agents are navigating shifting client needs and preferences.

5. Technological Integration:

Delve into the role of technology in reshaping real estate agent dynamics. From advanced data analytics to virtual reality tours, discover how agents are harnessing technology to streamline processes, enhance client experiences, and gain a competitive edge in the market.

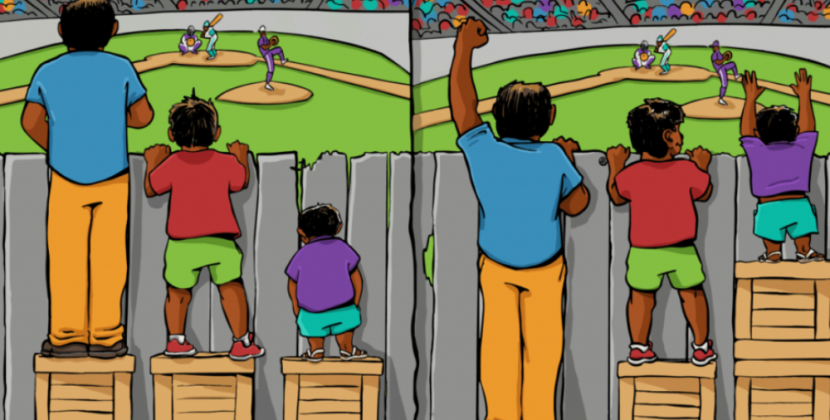

6. Collaboration and Competition:

Explore the delicate balance between collaboration and competition among real estate agents. From cooperative efforts within brokerages to competition for listings and clients, understand how agents navigate these dynamics to achieve success in the industry.

7. Looking Ahead:

Peer into the future of real estate agent dynamics and anticipate the trends that may shape the industry in the coming months. From continued technological advancements to shifting consumer preferences, gain insights into the factors that will influence agent strategies and behaviors moving forward.

Conclusion:

As Mark Davis reflects on the subtle shifts observed in real estate agent dynamics during March, he emphasizes the importance of adaptability and insight-driven decision-making in navigating the ever-evolving market landscape. With a deep understanding of emerging trends and client needs, real estate agents are poised to thrive amidst change and uncertainty, leveraging new strategies and tools to achieve success in the industry.

Visual Table for Key Points:

| Key Aspects | Description |

|---|---|

| Overview of Agent Dynamics | Roles, interactions, and strategies of real estate agents within the market. |

| March’s Insights | Nuanced changes in agent behavior and trends observed during March. |

| Adaptation to Market Trends | How agents are adjusting strategies in response to emerging market conditions. |

| Evolving Client Relationships | Changes in client preferences and expectations, and agents’ responses to meet them. |

| Technological Integration | Role of technology in reshaping processes, client experiences, and gaining a competitive edge. |

| Collaboration and Competition | Balancing cooperative efforts with competition among agents and brokerages. |

| Looking Ahead | Anticipated trends and factors that will influence agent strategies and behaviors in the future. |

Comparative Table:

| Aspect | March’s Real Estate Agent Dynamics | Traditional Real Estate Agent Interactions |

|---|---|---|

| Overview of Roles | Varied roles including listing, negotiation, and client representation | Similar roles with less emphasis on digital tools and technology |

| Adaptation to Market Trends | Swift adaptation to emerging market trends and dynamics | Slower response to changes with reliance on traditional methods |

| Embracing Technology | Integration of advanced technology tools and digital marketing | Limited use of technology beyond basic listings and marketing |

| Client Relationship Shifts | Heightened focus on personalized service and virtual interactions | Less emphasis on virtual viewings and personalized experiences |

| Collaboration vs. Competition | Balance between collaboration within brokerages and competition for clients | Limited collaboration and more individualistic approaches |

| Future Preparedness | Forward-thinking approach to anticipate and adapt to future trends | Reactive approach with less anticipation of market shifts |

As Mark Davis explores the subtle shifts in real estate agent dynamics revealed by Relitix’s analysis, he invites readers to delve into the evolving landscape of the industry and the strategies agents are employing to navigate change and seize opportunities for success.