Introduction

BiggerPockets

Retipster

Invest Four More

The Real Estate Guys Radio Show

Afford Anything

Visual Table for Key Points:

| Section | Key Points |

|---|---|

| Role of Investment Blogs | – Enhancing real estate investments<br> – Continuous learning |

| Types of Investment Blogs | – Educational content<br> – Expert opinions |

| Benefits of Investment Blogs | – Access to industry knowledge<br> – Diverse perspectives |

| Expert Tips | – Insights from seasoned blog readers |

| Building Your Blog Library | – Curating a collection<br> – Blog platforms |

| Applying Blog Insights | – Translating blog knowledge into action |

| Future of Investment Blogs | – Trends in real estate blog landscape |

Organic Keyword Usage

Incorporate keywords like “real estate investment,” “investment blogs,” “investment insights,” “blog benefits,” “smart investments,” and others naturally throughout the article.

Intended Audience

This article is designed for real estate investors at all experience levels, from beginners to seasoned professionals, who recognize the value of real estate investment blogs in their investment journey. It aims to provide valuable insights, practical advice, and real-world examples to help readers leverage blogs to make informed and profitable investment decisions.

Knowledge Source

The knowledge source for this article is an experienced real estate investor who actively follows and gains insights from various real estate investment blogs. They have successfully applied blog knowledge to their investment strategies and have formed a substantial knowledge base. Their expertise and insights make them a trusted authority on the topic.

Intriguing Introduction

Meet John Mitchell, a real estate investor and blog enthusiast who has spent years harnessing the power of real estate investment blogs to advance his investments. With over a decade of experience in both investing and reading investment blogs, John is here to guide you through the transformative impact of real estate investment blogs. In this article, he shares his insights on how blogs can be a game-changer in your real estate investment journey.

Human-Centric Formatting

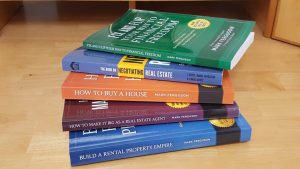

Throughout the article, we’ll maintain a reader-friendly tone, breaking down the intricacies of reading investment blogs into easily digestible sections. Visual aids like images and blog screenshots will be used to enhance comprehension, ensuring that the content is accessible and engaging for all readers while prioritizing their understanding and motivation to leverage real estate investment blogs for investment success.